Donor Stories

Gifts From the Heart

Gifts From the Heart

Rady Children's is so much more than a hospital—it is a lifesaving organization with the power to improve kids’ lives and their futures. In addition to our annual giving, my husband, Craig, and I are including Rady Children's in our estate because we want to support these deserving children and wonderful programs even when we’re no longer around. More

Why Paying It Forward Makes Sense

Why Paying It Forward Makes Sense

Rady Children's Hospital has been in my life for a very long time. When reflecting back on this, it makes sense that we pay it forward with a gift that provides care for other children and their families in the future. More

My Inspiration For Giving Back

My Inspiration For Giving Back

Giving back is the least I can do. Every day I wake up thankful for Rady Children's because I know Erin is safe and happy here. I also know that without access to care at Rady Children's, Erin would not be alive today. More

Healthy Futures Start with You

Healthy Futures Start with You

"Fu-Ping and I are inspired by Rady Children's complimentary and integrative medicine program at the Peckham Center for Cancer and Blood Disorders." These important programs are not funded by insurance, yet create a healing environment for patients who are undergoing often painful and stressful procedures. Sustaining this philosophy of caring for the whole child—mind and body—is the right thing to do." More

Helping the Lives of Children Today

Helping the Lives of Children Today

Sometimes the best investment is extremely low risk yet yields immeasurable returns. For Chris and Missy Tresse who have invested time, talent and financial gifts in Rady Children's, the benefits they receive from their investment have been repaid tenfold. More

A Gift to Last Many Lifetimes: Shizue Maruyama

A Gift to Last Many Lifetimes: Shizue Maruyama

Shizue Maruyama never visited Rady Children's campus. She and her husband, Tom, didn't have children of their own. But through a generous plan, they created a loving future for countless children. More

A Gift to Last Many Lifetimes: James Roy

Before his passing, James Roy did something guaranteed to make an impact for years to come: he left part of his estate to Rady Children's Peckham Center for Cancer and Blood Disorders. More

Growing Philanthropic Ideas

Growing Philanthropic Ideas

Chuck Hirst was born with a speech impairment that presented social challenges for him as a child. He underwent a surgical procedure to correct his impairment, but his peers often treated him cruelly, making learning difficult. More

A Gift Today for the Children of Tomorrow

A Gift Today for the Children of Tomorrow

"There are so many things I'm proud of at Rady Children's," says Maria Assaraf, chair of the Rady Children's Hospital Foundation Board of Trustees. "I'm proud of how we are thinking outside the box, and really growing our Hospital into a transformational healthcare system that benefits children not only here in San Diego, but around the world." More

Generosity as a Way of Life

Generosity as a Way of Life

"My idea of philanthropy is to give it all away," Jere says. "I feel like if I can do something to help someone else, then that's what I should do." More

Ensuring World-Class Care When it’s Needed Most

Ensuring World-Class Care When it’s Needed Most

While hiking the Grand Canyon in 1987, John Jenkins’ then 8-year-old daughter, Kristen, became acutely ill and couldn’t finish the journey. John packed up the family’s RV and headed straight to Rady Children’s. More

Parent. Physician. Partner. A Message from Dr. Hank Chambers

Parent. Physician. Partner. A Message from Dr. Hank Chambers

As a physician at Rady Children's, I am honored to help the children in our community. I know we offer the very best care. I know this. But I truly felt it when my own son was a patient here. More

Gary Stein

Gary Stein

Minutes into a conversation about his involvement with philanthropic causes, Gary Stein's house phone rings. He disappears for a few minutes into the kitchen and then comes back, apologizing. "That was a call from a realtor," he says. "I'm starting a new business. It's weird—I'm going to be a wasabi farmer." More

Gifts for the Future—Inspiration Now

Gifts for the Future—Inspiration Now

A Legacy Circle gift—including Rady Children's in your estate plan—is an incredibly meaningful way to help us keep our covenant to always care for the kids in our community. More

The Heart of Giving

The Heart of Giving

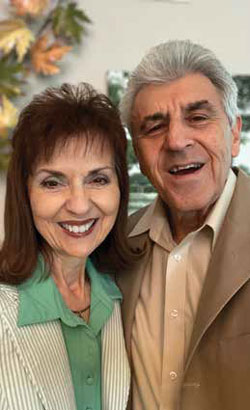

Vince and Camilla Borchers' own son, Chris, spent the first two months of his life in the Neonatal Intensive Care Unit at Rady Children's Hospital San Diego. More

The Power of Giving to Others

The Power of Giving to Others

Mona and Sam Morebello are an important part of the history of Rady Children's. More

Barbara Brown: Dividends of Love and Care

Barbara Brown: Dividends of Love and Care

Barbara Brown has devoted a good portion of her life to supporting Rady Children's—tireless volunteer, fundraiser extraordinaire, Foundation Board of Trustees chair and Charity Ball chair—the list goes on and on. More

Gordon's Legacy Changes Lives Forever

Gordon's Legacy Changes Lives Forever

Roy Gordon, a World War II pilot, dedicated his life to his country, touching the lives of many. But his impact did not stop there. More

A Brave Soldier Leaves Quiet but Powerful Legacy

A Brave Soldier Leaves Quiet but Powerful Legacy

Josef Fisher was a gentleman who lived with great taste, surrounded by his exceptional collection of objets d'art collected from his world travels. More

A Life Remembered, a Legacy Ensured

A Life Remembered, a Legacy Ensured

Bernice Fingerman never met her stepson, Peter David; he passed away at the age of 15, decades before she met and married his father, Harry. But Bernice has always been profoundly touched by Harry's love for Peter, who developed cerebral palsy at a young age. More

Bettie and John Walsh

In 2002, Bettie Walsh and her husband, John, used money from an inheritance to create a charitable gift annuity to benefit Children's Chadwick Center for Children and Families. More

Nancy and Gordon Kinley

Nancy and Gordon Kinley

Nancy and Gordon Kinley donated two pieces of real estate, valued at $625,000, to Children's in exchange for a charitable gift annuity. More

J. Monroe Jones

Mary Eleanor and J. Monroe Jones created a charitable gift annuity in 2001. Mary Eleanor passed away in 2003 at the age of 87, but Monroe continued the tradition of giving to Children's. More

Masako and Jim Falk

Masako and Jim Falk

Masako and Jim Falk became donors to Children's in the mid-1990s through the creation of a charitable remainder unitrust (CRUT). More

Norma and Robert Fethler Help Kids by Donating Real Estate

Norma and Robert Fethler Help Kids by Donating Real Estate

"I know all too well what it's like to be hospitalized," says Norma Fethler. She spent the entire first nine years of her life between a hospital for crippled children near Chicago and a convalescent home in nearby St. Charles, Illinois. More

Al Roth

Albert (Al) Roth was a volunteer at Children's for eight years, contributing a total of 3,415 hours. In 2000, he was presented with the President's Award in recognition of his dedicated service to Children's. More

A Large Bequest From Petite Gloria Brown

A Large Bequest From Petite Gloria Brown

By all accounts, Gloria Brown was a petite woman—barely 5 feet tall. But she had an enormous heart, especially for kids. More

Caring for Other People's Children

Not many people would offer to care for someone else's children. But Jim and Masako Falk have been doing just that since the mid-1990s, through their generous support of Children's Hospital and Health Center. More

Special People—Special Gifts

Bettie Walsh didn't set out to be one of Children's benefactors. Twenty years ago, she was asked by her women's club to donate toys to Children's. She agreed, and later she was asked for dolls—not just any dolls, but anatomically correct ones that could be used in child abuse programs. She began making them for the Chadwick Center for Children and Families, and the demand grew exponentially. More

The Gift That Keeps on Giving

The Gift That Keeps on Giving

When it comes to Children's, it's better to give and receive. More

Information contained herein was accurate at the time of posting. The information on this website is not intended as legal or tax advice. For such advice, please consult an attorney or tax advisor. Figures cited in any examples are for illustrative purposes only. References to tax rates include federal taxes only and are subject to change. State law may further impact your individual results. California residents: Annuities are subject to regulation by the State of California. Payments under such agreements, however, are not protected or otherwise guaranteed by any government agency or the California Life and Health Insurance Guarantee Association. Oklahoma residents: A charitable gift annuity is not regulated by the Oklahoma Insurance Department and is not protected by a guaranty association affiliated with the Oklahoma Insurance Department. South Dakota residents: Charitable gift annuities are not regulated by and are not under the jurisdiction of the South Dakota Division of Insurance.